Online accounting integrated into your ERP software

With integrated online accounting in your ERP system, you can easily get your figures, finances and reminders in order.

All company figures from a single source:

With integrated online accounting in your ERP system, you can easily get your figures, finances and reminders in order.

All company figures from a single source:

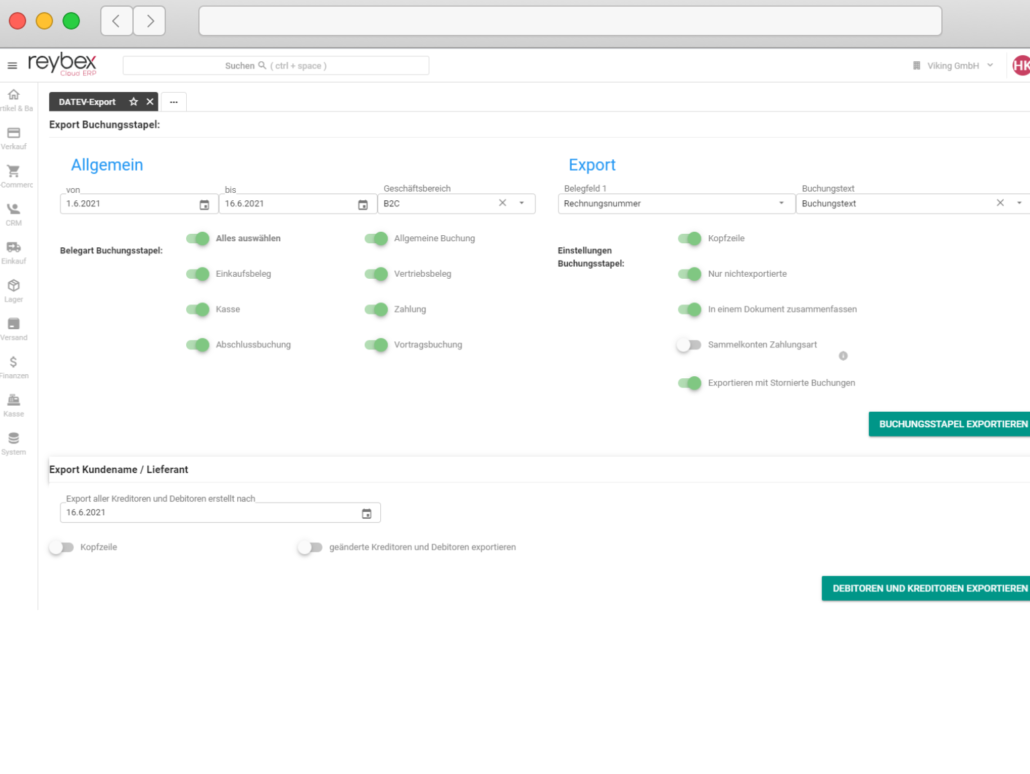

A DATEV export is also available for transmitting your business figures to your tax consultant or auditor. This means that you always provide tidy and easy-to-process data.

Documentation on DATEV export with reybex can be found here.

For your medium-sized or large company, reybex offers a professional financial accounting system in addition to the basic version. In addition to posting incoming invoices, it also includes the posting of supplier payments. Also integrated is an account sheet with a chronological list of all postings in the selected posting account as well as a totals and balances list for an overview of all posted accounts.

All business transactions are recorded here in the form of opening balances, movements and closing balances as an overview of the account movements. Interfaces to the tax consultant and the tax authorities via DATEV and ELSTER are directly integrated.

Cost center accounting provides a better overview of the link between cost element and cost unit accounting. It makes it easier to clarify where which costs have been incurred and to check the profitability of your company. The BWA report (business management analysis) provides you with a report on the overall earnings situation of your company.

With reybex, you don’t have to compile the documents for the tax authorities in Excel files, because you receive the evaluations directly from your reybex. In the recapitulative statements, you receive a list of all business transactions for notification to the tax authorities. All business transactions are booked in reybex in an unalterable and GoBD-compliant manner as proof for the tax authorities.

You can also manage your financial periods to separate the past and future financial years. You can use the ELSTER interface to send your advance VAT return directly from reybex to the tax office.

Wir beraten Sie gern – per Telefon, E-Mail oder bei einem unverbindlichen Beratungsgespräch.

| Feature | Grundfunktionen | FiBu Professional *optional zubuchbar |

|---|---|---|

| Kontenplan (SKR 03) & (SKR 04) | ||

| Offene Posten Verwaltung | ||

| Mahnwesen mit autom. E-Mail | ||

| DATEV Export | ||

| Zahlungseingang -> Kontozuordnung | ||

| Buchen von Eingangsrechnungen | ||

| E-Banking, PayPal & Amazon Pay | ||

| Zahlungsabgleich | ||

| Autom. Verbuchen von Belegen | ||

| Buchen von Lieferantenzahlungen | ||

| Zusammenfassende Meldung | ||

| Verbuchen aller Geschäftsvorfälle | ||

| Kontenblatt | ||

| BWA Report | ||

| Summen- und Saldenliste | ||

| Kostenstellenrechnung | ||

| Verwalten von Finanzperioden | ||

| ELSTER Schnittstelle |

| inklusive | optional |